Support And Resistance For Dummies

You’ve probably heard the terms support and resistance before. Either in relation to Forex trading or to stock trading. If you’re like many traders, you may not be sure what exactly they mean. Support and resistance are unique tools that traders can use to help predict the direction of price movement. Gauge potential risk, but they are much more complicated than they might seem at first glance. In this post, we’ll examine what support and resistance really are why they occur, and how you can begin using them in your own trading strategy today!

Currency Trading

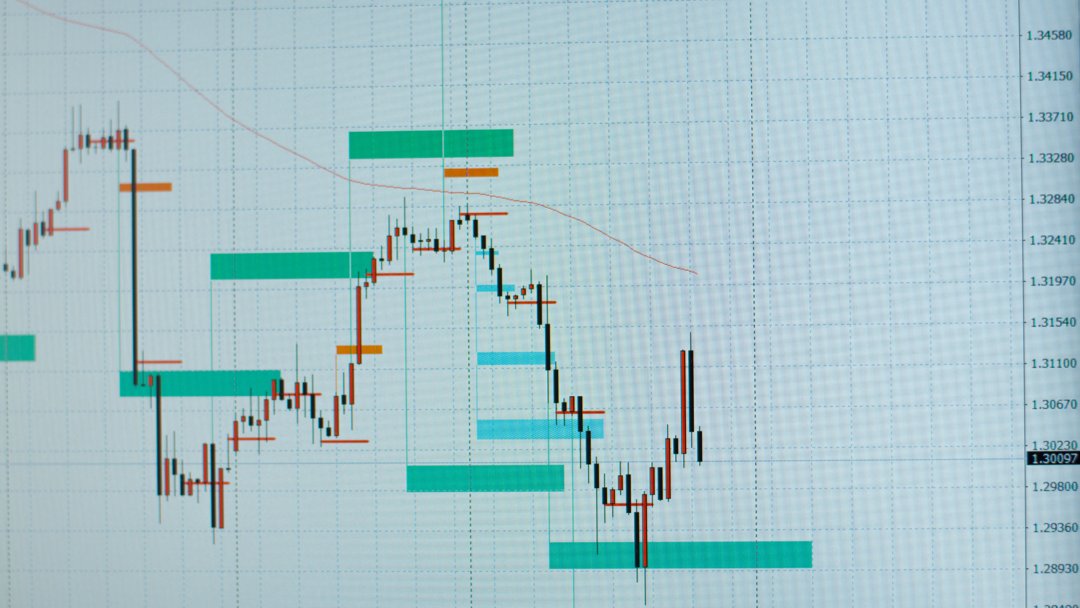

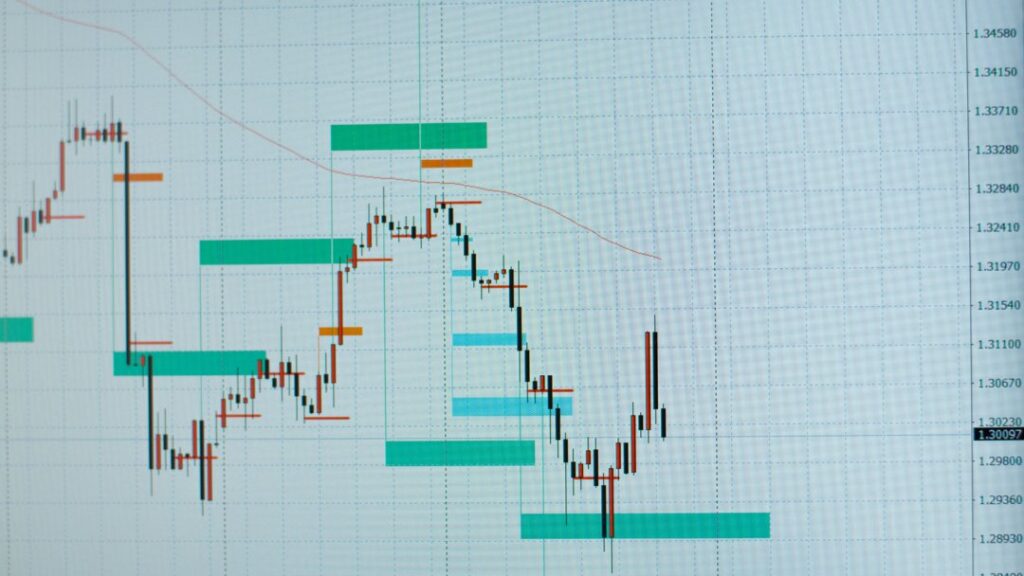

In currency trading, a price level at which a downtrend is expected to stop due to a concentration of demand or buying interest is known as support. The support line is formed when the price of assets or securities declines and demand for the shares rises. Conversely, resistance zones form as a result of increased selling interest when prices climb. Resistance refers to prices on a chart that tend to act as a ceiling. The classic example of support and resistance are two parallel lines on the charts. This is a very helpful indicator when trading currencies and stocks.

Support and Resistance on Online Trading

The bottom line (support) shows places where buyers stepped in and bought up an asset’s falling price, preventing it from dropping further. Conversely, the top line (resistance) shows places where sellers stepped in and sold off an asset’s rising price, preventing it from climbing further. One of the most useful ways to use support and resistance levels is in determining trade entry and exit points. You can enter a trade when the price breaks above resistance, or you can sell if it falls below support.

A second approach used by many traders is to look for breakouts above resistance or breakdowns below support, which are identified by large gaps up or down. If prices close outside of these levels the next day, we refer to them as breakout pullbacks. An important rule-of-thumb that applies to both support and resistance levels is that they often represent areas where supply and demand have recently been in equilibrium. That means there may be buyers who were willing to pay slightly higher prices (support) and sellers who were willing to accept slightly lower prices (resistance).

FOREX Trading Support and Resistance

Moving averages and trendlines are both important tools in the technical analysis used in forex trading. Moving averages show you where security has been trading over time, while trend lines show you where it’s headed. A moving average can help spot a short-term uptrend or downtrend by showing whether prices are rising or falling during a set time period, like three months. This can be helpful for identifying support and resistance areas on charts because areas of higher demand and higher supply will create resistance by pushing the price down when it tries to go up, and likewise support by pushing the price up when it tries to go down. Using moving averages and trend lines together gives traders more detailed levels at which to place their trades, helping them find better entry points for bigger gains.

Importance of Support and Resistance of Online Trading

All investments involve some degree of risk. If you intend to purchase securities – such as currencies, commodities, stocks, bonds, or mutual funds – it’s important that you understand before you invest that you could lose some or all of your money. Have a question? Want to learn more? There are more than enough learning sessions to get you started, regardless of your learning style. With Smartrade, you can pick from experienced-led courses and study at your own speed, with lifelong access to free forex training and one-on-one coaching. You’ll also learn the fundamentals of Trading Forex, CFDs, Stocks, and Commodities. Learn more about Smartrade and get started right away.

To learn more about FOREX TRADING and many more visit our website at: https://smartradeph.com/

Like our social media pages to see schedules for our free online training/seminars and one on one

coaching.

Facebook: https://www.facebook.com/smartradeph/

Instagram: https://www.instagram.com/smartradeph/

Linkedin: https://www.linkedin.com/company/smartrade-philippines/

Twitter: https://twitter.com/smartradeph

Youtube: https://www.youtube.com/c/SmarTradePH

Tiktok: https://www.tiktok.com/tag/smartrade