Forex Trading vs. Stock Trading: Which is Right for You?

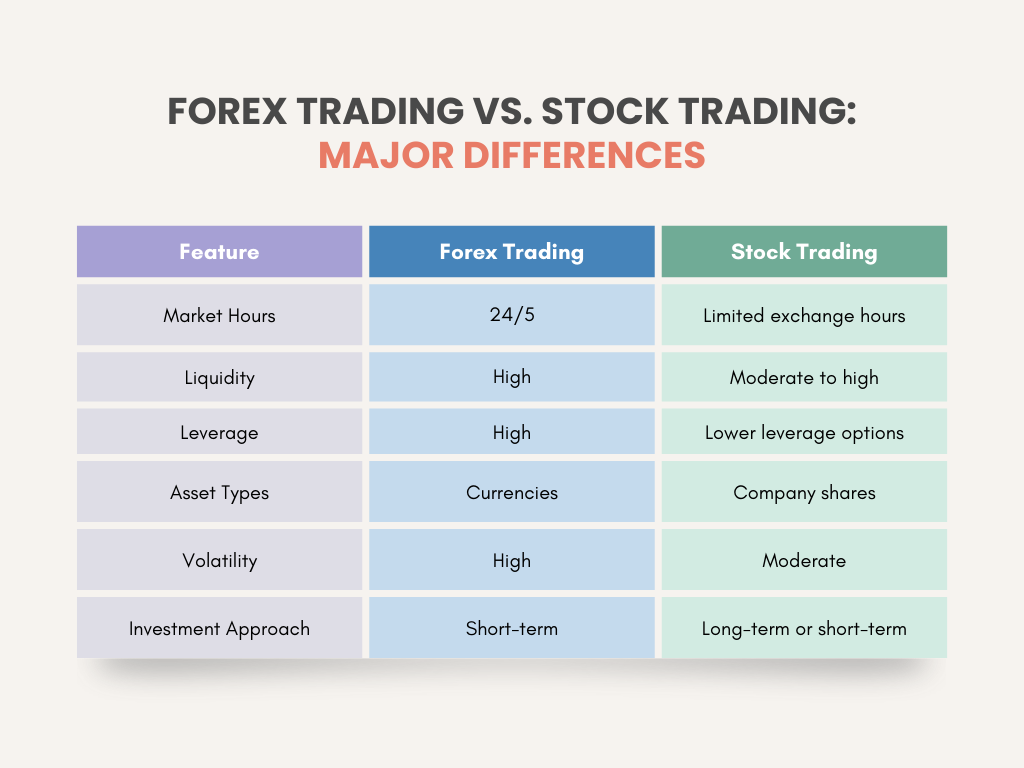

Navigating the world of trading can be daunting, especially when deciding between Forex and Stocks. This blog post breaks down the core differences between Forex and Stock trading – from the 24-hour market and high liquidity of Forex to company ownership and the potential for wealth-building in Stocks. We’ll cover everything you need to make an informed decision about where to invest your time and capital.

Understanding the Forex Market

Trading forex currencies involves the exchange of currency pairs in a decentralized global market. It operates 24 hours a day, five days a week, allowing traders to engage in continuous trading. The forex market is highly liquid, with significant trading volume, making it attractive to those seeking short-term opportunities. Forex and stock trading often differs in terms of market accessibility and trading volume.

Key Features

- High Liquidity: Large trading volume ensures ease of trade execution.

- Leverage Opportunities: Traders can control larger positions with smaller capital.

- Market Accessibility: The 24-hour market structure provides flexible trading hours.

- Currency Pairs: Trading is based on major, minor, and exotic currency pairs.

Understanding the Stock Market

Trading stocks involves buying and selling shares of publicly traded companies. Unlike forex, stock markets operate within fixed hours depending on the exchange. Investors participate in stock trading for long-term capital appreciation or dividend income. When comparing forex to stock trading, stock investments are often seen as a more traditional approach to wealth building.

Key Features

- Company Ownership: Stockholders own shares in a company and may receive dividends.

- Market Hours: Trading is conducted during stock exchange hours.

- Volatility Levels: Stocks are influenced by company performance, earnings reports, and economic trends.

- Diversification: Investors can build portfolios across various industries.

Which Trading Option is Right for You?

- Trade forex if you prefer short-term trades, high liquidity, and market accessibility.

- Trade stocks if you seek long-term investments and want ownership in companies.

Both trading options offer unique opportunities, but the choice depends on individual risk tolerance, investment goals, and market understanding. Conducting research and using demo accounts can help in making informed decisions before committing capital. When deciding between forex and stock trading, it is essential to consider risk factors, investment strategies, and market conditions.

By analyzing the key aspects of the two, traders can identify the most suitable market based on their trading preferences and financial objectives.

SmarTrade Cinco de Mayo Sparks Team Spirit in Makati

SmarTrade Cinco de Mayo Celebration Ignites Team Spirit in Makati SmarTrade employees celebrate Cinco de Mayo with President and CEO Joyce Mayo, strengthening team spirit

Understanding Leverage in Forex: A Double-Edged Sword

Understanding Leverage in Forex: A Double-Edged Sword What is Leverage in Forex? Leverage in forex refers to the use of borrowed funds to increase the

Forex Trading Indicators Every Trader Should Know

Forex Trading Indicators Every Trader Should Know Traders widely use forex trading indicators to analyze market trends and make informed decisions. These tools interpret price

Compounding in Online Trading: Building Wealth Over Time

The Power of Compounding in Trading: Building Wealth Over Time Compounding in online trading is considered one of the most effective strategies for long-term wealth

Online Trading for OFWs: What You Need to Know

Online Trading as an Investment Opportunity for OFWs: What You Need to Know The landscape of investment opportunities has expanded significantly, particularly for Overseas Filipino

Emotional Trading: How to Stay Calm and Collected

The Role of Emotions in Trading: How to Stay Calm and Collected Emotions play a significant role in trading decisions, often influencing traders’ actions more