Elliot Wave

What is Elliot Wave?

Ralph Nelson Elliott created the Elliott Wave theory of financial market analysis in the late 1920s and early 1930s. It is predicated on the notion that investor psychology causes financial markets, including stocks, commodities, and currencies, to move in predictable patterns. Elliott thought that by paying attention to these repeating wave patterns, market movements might be understood and forecasted.

The hypothesis is based on the idea of fractals, in which smaller patterns mirror bigger ones and produce a self-similar structure. Elliott distinguished two primary wave types.

Impulse Waves

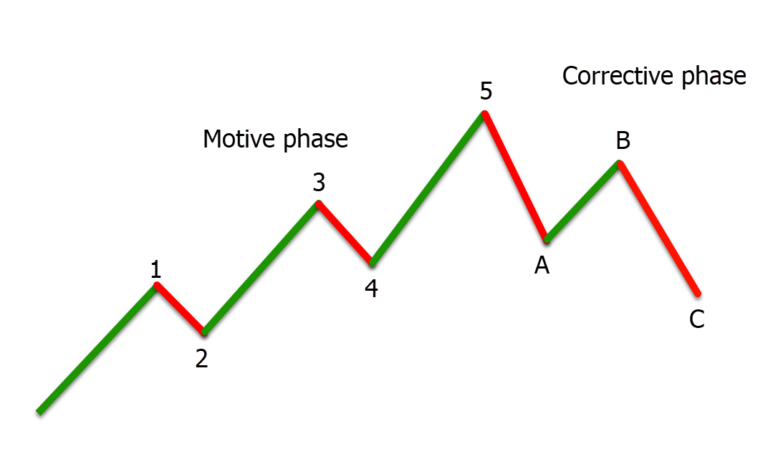

These are those waves that go in the direction of the market’s primary trend. Five smaller waves, numbered 1, 2, 3, 4, and 5, make up an impulse wave. Waves 1, 3, and 5 move toward the primary trend, whereas waves 2 and 4 move against it.

Corrective Waves

These waves travel in the opposite direction of the primary trend. Three smaller waves, A, B, and C, make up corrective waves. While wave B advances against the more significant trend, waves A and C move in their direction.

According to the Elliott Wave theory, a three-wave corrective pattern will come after a five-wave impulse pattern (bearish or bullish) is complete. This process then repeats itself in a fractal pattern. In other words, higher-degree waves comprise smaller-degree waves, and smaller-degree waves are a component of both.

Traders and analysts use Elliott Wave analysis to spot probable market turning moments and forecast future price movements based on wave patterns. Elliott Wave analysis is subjective and open to interpretation, though. Therefore, it’s crucial to remember that not all market participants support this theory. It should be used with other indicators and analysis tools for better decision-making, just like any technical analysis technique in trading and investing.

Remember that market moves can be unpredictable and that the Elliott Wave theory is not a magic wand. It’s crucial to incorporate it into a larger analysis rather than relying on it while making trading or investment decisions. To further your grasp of Elliott Wave theory and its application, numerous resources are accessible, including books, online tutorials, and courses.

How to trade Elliot Wave

Invest some time in mastering the fundamentals of Elliott Wave theory

To thoroughly comprehend the theory’s operation and how to spot wave patterns, read books, go to webinars, and watch tutorials.

Determine the dominant trend in the market

If you are interested in before beginning the Elliott Wave analysis. The Elliott Wave theory works best in markets that are trending.

Start with Higher Time Frames

Study higher time frames (such as daily or weekly charts) to find significant wave patterns. The overall trend is more clearly visible in higher time frames.

Use historical price charts to detect and count waves

As you practice wave counting, you’ll start with simple waves and work your way up to more complicated ones.

Using Fibonacci retracement and extension techniques

Use Fibonacci ratios to discover probable reversal and goal levels in wave patterns. Frequently, Fibonacci ratios are essential in Elliott Wave interpretation.

Consider using additional technical indicators

To verify the indications produced by Elliott Wave analysis, such as moving averages, RSI, MACD, etc. Your analysis’ precision can be improved by combining various techniques.

Elliott Wave's interpretation

It demands patience and objectivity, so please be both. Try to avoid manipulating a wave count to produce the results you want. Analyze with the market in mind.

Understand the Elliott Wave theory's principles and guidelines

It includes not allowing wave 3 to be the smallest wave in an impulse and not allowing wave 2 to extend past the beginning of wave 1.

Watch for Wave Failure

Be ready to rethink your research if the market behaves differently than anticipated and the wave count fails. Due to the unpredictable nature of market moves, flexibility is essential.

Implement sound risk management strategies

Trading is inherently risky. Set stop-loss levels, adhere to a strict trading plan, and manage your risk responsibly.

Maintain a trading journal

To keep track of your Elliott Wave research, trade setups, and results. This will enable you to monitor your development and learn from your achievements and failures.

Backtest Your Analysis

Evaluate the performance of your Elliott Wave analysis using historical data before using it in actual trading.

Things to remember

Remember that Elliott Wave analysis is only one tool in your arsenal of trading resources. It is crucial to incorporate it with additional methods of analysis and risk management techniques. Trading by the Elliott Wave theory can be difficult and is not guaranteed to be accurate. Therefore, it’s crucial to continue learning, practicing, and refining your trading skills.