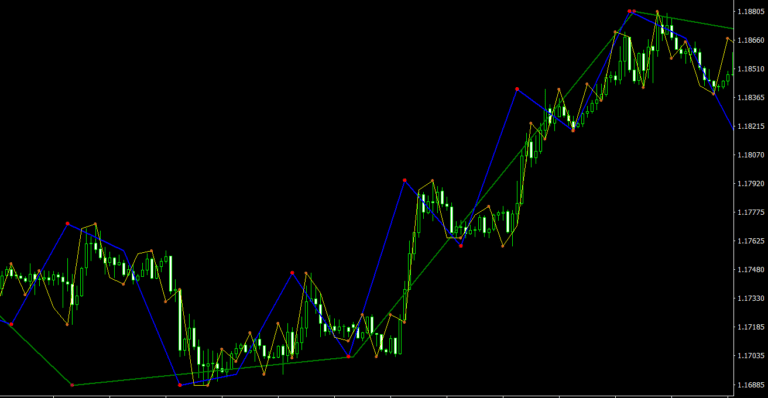

Elliot Wave

Elliott Wave theory is a technical analysis of price patterns related to changes in investor sentiment and psychology. The theory identifies impulse waves that establish a pattern and corrective waves that oppose the larger trend.

Is it effective?

The Elliott wave principle, as popularly practiced, is not a legitimate theory, but a story, and a compelling one that is eloquently told by Robert Prechter. The account is especially persuasive because EWP has the seemingly remarkable ability to fit any segment of market history down to its most minute fluctuations.

Concept

It’s a form of technical analysis that looks for recurrent long-term price patterns related to persistent changes in investor sentiment and psychology. The theory identifies impulse waves that set up a pattern and corrective waves that oppose the larger trend.

Accuracy

The accuracy level is 84.9% of the projections have come true when tracking the accuracy of particular Elliott Waves. This is not the first time. These findings have remained consistent while analyzing close to 5,000 random projections of 33 stocks of the S&P.

Use of Elliott Wave in Forex

If you cannot spot these patterns and money trails, you might need to revisit your Forex 101. However, a range of tools help you easily spot forex patterns and make accurate decisions. The Elliott Wave Theory is just one of them, which is very popular among traders.